A wedding dress retailer in Johannesburg allegedly shut down its shop without warning, leaving many brides without the gowns they paid for in full or most of the money upfront.

According to W24, the shop owners left a handwritten poster outside the shop saying “Due to the current economic state in our country and the rest of the world, Eurobride has not been able to recover financially to open our doors again. Regretfully we are not able to fulfill our obligations to all our clients.”

Nerissa was one of the unfortunate brides that lost money due to the closing of the shop. She saw a special on Facebook saying that there is a 50% special that was going on at Eurobide for bridal gowns. Her wedding was supposed to be in December and in August she went for a fitting and she says that it went well.

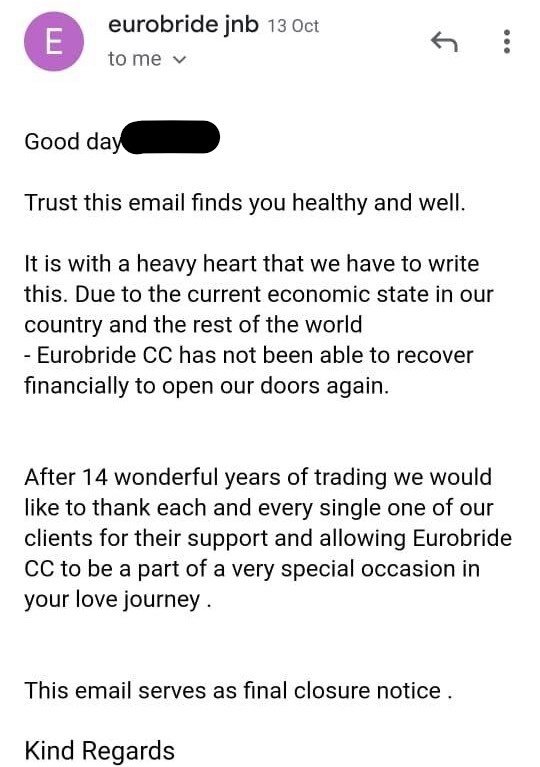

Speaking to W24, she explained that she paid R10 000 upfront for the dress and the full amount was R20 000. The lady at the shop asked her if she wanted to keep the dress and Nerissa thought it was easier to leave the dress at the shop so that she can come in for alterations without problems, little did she know that she was going to lose the money. She was supposed to go on her final fitting on November 16, 2020 but received an email on October 13 informing her of the closure.

She was not the only customer who suffered this loss, many brides went on social media and spoke about this.

The shop’s attorney Johan du Toit told Timeslive that “If our client has to meet every bride, they will honestly not get to all of them. As this is an incredibly time-consuming and expensive exercise for our client’s small team.”

A total of 29 brides are reportedly owed R473 950 by Eurobride, and took to protesting outside the store.

View this post on Instagram

View this post on Instagram

Attorney Du Toit sent letters to several Eurobride clients who had shared their experiences on social media, she responded to the accusations and said that Eurobride has had no new income for six months, yet still the same overheads. The postponement of all weddings came at a huge expense for the comapny, and the client was forced to make difficult decisions, due to the fact that they do not satisfy the solvency and liquidity test, and it would be negligent if they continued trading.

Pictures: Instagram/ Unsplash